The shockwaves of the pandemic and ongoing geopolitical tensions made dealmakers rethink their M&A strategies and adapt fast. In this highly turbulent environment, a virtual data room (VDR) becomes a strategic infrastructure for dealmaking.

For sellers, VDRs provide deeper visibility into buyer engagement. Features like activity tracking and granular user permissions offer insights that help sellers identify purchase interest early and tailor communications accordingly. For buyers, centralized and secure access to real-time data shortens due diligence cycles and reduces friction between legal, financial, and operational reviews.

Here, we explore what mergers and acquisitions are and how virtual data rooms simplify, safeguard, and accelerate every stage of the deal process. We also share the table with some of the best data room providers for M&A transactions.

What are mergers and acquisitions?

Mergers and acquisitions occur when two companies (or their assets) combine through various financial transactions. These transactions may include mergers, acquisitions, tender offers, consolidations, asset purchases, and management buyouts. The goal is usually to drive growth, expand market share, or gain strategic advantages.

Although “mergers” and “acquisitions” are often used interchangeably, their meanings differ:

- A merger happens when two companies of roughly equal size join forces to become a new single entity. This usually involves shared ownership and a new organizational structure. The goal is to create synergies and boost competitiveness.

- An acquisition implies a takeover of a smaller company by a larger one. In this case, the acquired company is absorbed into the buyer’s operations and may no longer exist as an independent entity.

Typically, mergers and acquisitions include the following five steps:

- Evaluation and a preliminary review. When a buyer is yet to be found, M&A starts with a confidential information memorandum (CIM) or a teaser. This document contains information (without divulging sensitive documents) that may interest a potential buyer considering M&A. Its goal is to attract interest from potential buyers or investors.

- Negotiations and letter of intent (LOI). Once the buyer shows interest, both parties enter negotiations. This phase often includes early discussions around antitrust concerns, regulatory considerations, labor matters, tax implications, and intellectual property rights. If both sides align on the deal’s structure and intent, they sign a Letter of Intent to outline the basic terms of the proposed transaction.

- Due diligence. The primary objectives of a due diligence study are to identify the principal risks brought by M&A, figure out fair pricing, and strengthen the bargaining position. The procedure may cover legal, fiscal, and financial aspects.

- Negotiations and closing the deal. When the due diligence process is complete, the prospective buyer reviews and assesses the findings and their significance to the deal with its advisors. Additionally, this would entail negotiating the ultimate cost and the warranties.

- Post-closure integration. At this point, it’s typical for the stock purchase or asset purchase agreement to incorporate provisions that take effect following the deal-closing: the parties’ further obligations, completion of the transfer of additional assets, fulfilling performance-based payouts (earn-outs), or completing regulatory filings, etc.

M&A outlook for 2025: market drivers and trends

The S&P Global update on the M&A market shares a cautious optimism for the mergers and acquisitions deals in 2025. They highlight that the market recovery is driven by favorable economic conditions and growing business confidence.

One of the main factors that drives the M&A market forward is the ongoing rate-cutting cycle that began in 2024. The global deal value reached $714.77 billion in Q4 2024. This is a significant growth compared to $501.89 billion in Q1 2023. This trend is expected to continue as lower interest rates make financing more affordable and help to close the gap between buyers and sellers.

The target M&A industries are the tech sector (specifically, AI and cloud security), the oil and gas industry, and the financial sector. High-profile transactions, such as Chevron’s $61 billion acquisition of Hess, demonstrate that the oil industry remains resilient despite regulatory scrutiny.

As for the regional trends, the Deloitte 2025 M&A trends survey shares that Canada, Mexico, Central America, France, and Germany are all increasingly attractive to dealmakers. This is due, in good part, to persistent geopolitical tensions around the world. In fact, M&A in Canada is expected to surge by over 35% as investors seek stable, resource-rich markets amid global uncertainty.

Similarly, Mexico and Central America benefit from nearshore trends, while France and Germany remain pillars of European dealmaking with their strong regulatory frameworks and innovation hubs. Geopolitical shifts have reshaped the M&A landscape and made these regions the new hotspots for strategic investments.

What is the M&A data room?

The M&A virtual data room is a secure online space where users can store all the confidential documents required for mergers and acquisitions, the due diligence process, initial public offering, capital raising, and other complex deals.

The data room makes it easy to organize important documents and share them with trusted participants. This allows businesses to make different processes, like extensive due diligence, faster and ease the burden of collecting and disclosing confidential information.

Best virtual data room providers for M&A

G2 currently lists 89 virtual data room providers, and choosing the right one might take days, or even weeks. To help you narrow down your choice, we have selected the top companies with the best user ratings and positive reviews. Check it out to compare and decide which one will be the strong suit for successful M&A and due diligence processes.

| Provider | Key Features | Efficiency |

|---|---|---|

| Ideals Visit Website |

| In addition to sophisticated security features, Ideals virtual data room offers custom branding, auto-notifications for new activity, and an advanced Q&A module. You can protect all deal documents with 8 levels of user permissions and the ability to track any data room interaction with complete audit logs. Moreover, the Ideals virtual data room facilitates international cooperation with potential buyers as the platform is available in 15 languages. Finally, Ideals offers industry-leading customer support available 24/7, including weekends and holidays. You can get expert assistance via chat in as little as 30 seconds. |

| Merrill Datasite View Profile |

| Inviting virtual data room users and setting permissions in bulk saves time in complex transactions with multiple parties. Furthermore, the AI-enhanced Datasite automates file categorization and allows you to find and tag over 100 common data types. Optical character recognition shows search results for any file format and sends you a notification if data matching your search terms is added. Integrated trackers, in turn, simplify the pre-diligence process since you can share and track to-dos directly from the platform. |

| Intralinks View Profile |

| File-level encryption protects confidential data at rest and provides secure document sharing, which is critical for M&A. 16 user roles distribute document access based on authorized users’ tasks, so data never falls into the wrong hands. With reporting tools, you keep everyone on the same page and share important VDR metrics with the deal team. Also, the virtual data room provider offers built-in Zoom and Q&A collaboration tools to support seamless communication between participants from any location. |

| Ansarada View Profile |

| Ansarada online data rooms save all versions of deal documents so you can refer back to them if needed. In addition, smart redaction detects patterns across nine languages. Deal Workflow streamlines setting up checklists and creating workflows to manage multiple processes throughout a deal lifecycle. Finally, this virtual data room serves as an AI-based analyst predicting the outcome of a deal with 97% accuracy. |

| Box View Profile |

| Box virtual data room software offers dynamic watermarks for secure file sharing with buyers and other interested parties. You can view 120+ file types without additional plugins, which speeds up the due diligence process. Plus, the Box Skills solution offers AI technologies like speech-to-text transcription, image labeling, and natural language comprehension for uncovering the untapped value from documents. Finally, Box has the edge over most virtual data rooms regarding partner integrations. It’s because the platform includes solutions well mastered by most users, such as DocuSign, O365, Google Docs, Zoom, etc. |

| Firmex View Profile |

| Firmex data room solutions allow you to restrict access to printing, viewing, and saving, apply watermarks, and block sensitive information. When you set up data room access for a specific person, you can view it through that user’s eyes using the View As tool, one of the security measures for ensuring against missteps when setting permissions. Of particular value for working on the go is Email In, which allows you to upload files from your phone to a virtual data room. |

It is worth noting that the VDR solutions are different and the concept of the best virtual data rooms is rather relative. For example, those who need unparalleled data protection combined with an intuitive interface and tailored pricing may opt for the Ideals virtual data room, while users who need tools based on artificial intelligence will prefer Ansarada. That is why it is advisable to explore virtual data room pricing to narrow down the choice and request a free trial to explore the features and usability of the platform before committing

How do VDRs simplify the M&A process?

The biggest advantage of virtual data room services over traditional physical data rooms is the ability to handle key tasks, like document sharing, reviewing, and signing, entirely online. Here’s how VDRs streamline the M&A process:

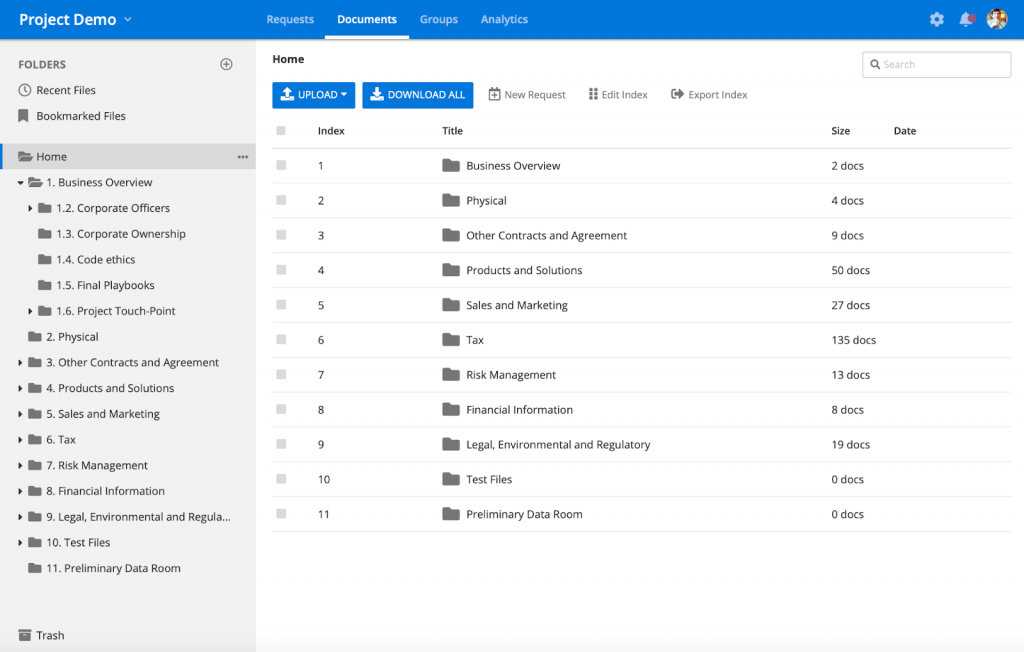

Improved document organization

M&A transactions require an exchange of multiple documents across the companies. Data rooms help to organize these documents using indexing, so it’s easy to get your data structured and quickly find anything you need.

Increased data security

Security is one of the biggest reasons companies choose to use VDRs instead of basic file-sharing tools like Google Drive for M&A. A well-built VDR protects sensitive business information with real-time data backups, secure data centers, multi-layered encryption, customizable user permissions, and two-factor authentication, among other features.

Usually, VDRs comply with key industry standards like SOC 2, GDPR, and HIPAA. These standards provide data privacy during deals between financial institutions, healthcare organizations, insurance companies, and other highly regulated areas.In fact, the role of data security has never been more important than now as the global costs of cybercrimes are skyrocketing. By the end of 2025, the number will reach a staggering $10.5 trillion, as stated in this report by Cybersecurity Ventures. The use of a virtual data room can help to lower the risk of breaches, leaks, or unauthorized access.

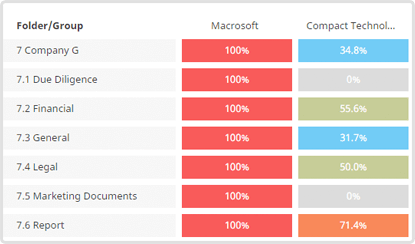

Extensive data room activity reporting

VDRs provide insights into activity tracking. Users can track the document interaction history to get real-time insights. Specifically, they can see how long a certain user has been browsing a particular file. Some of the best data rooms also offer color-coded reports and a snapshot of group activity, like this one:

Accelerated deal management process

Virtual data rooms speed up the due diligence during M&A transactions. Physical data rooms require a lot of long meetings, parties traveling to review and sign the documents, etc. An online data room saves a lot of time that could be spent on these activities. Also, the VDRs enable international M&A deals, as the process doesn’t require meeting in person or traveling to another country. Users can access the data room at any time, from anywhere in the world.

What to include in the online data room for M&A?

A virtual data room facilitates smooth and transparent communication between the deal parties. It should contain all the essential M&A information about the target company a potential buyer needs to conduct thorough due diligence. While the exact documents to include may vary based on the industry, company size, or deal type, there’s a standard set of materials that are typically expected in any professional M&A data room checklist.

We’ve outlined the essential documents below. These are the materials most buyers will be looking for to evaluate a business, assess risks, and estimate the deal value.

General corporate documents

- Business licenses

- Business permits

- List of jurisdictions where the company is qualified to operate

- Cap table

- Partnership agreements

- Pro forma statements for the upcoming year

- Voting agreements

- Information about all the other assets (if any)

Financials

- Monthly info about financial transactions

- Audited financial statements (last 3 years)

- Banking accounts

- Capital leases

- Pricing policies

- Balance sheets, profit and loss statements, cash flow statements

- Information about previous cooperation with investment bankers (if any)

- Business transactions data

- Pro forma financial models and projections

- Capitalization table (cap table)

- Debt schedules and financial reporting controls

- Third-party financial evaluations and key financial ratios

Marketing materials

- Full list of current customers and key info about them

- Sales projections and assumptions

- Competitive analysis

- Key review of the main competitors

- Brand books on the existing products

- Summary of product launches

- Customer lists and major contracts

- Strategic partnership agreements

- Brand and trademark registrations

Information about the team

- Full list of employees by position, salary, date of hire

- Onboarding documents

- Organizational charts and employee contracts

- Compensation and benefits policies

- Employee turnover and satisfaction reports

- Labor union agreements and leadership succession plans

Intellectual property

- Patent trademarks

- Registered copyrights

- Domain name ownership

Information about the suppliers

- Full list of current and previous suppliers and manufacturers with their key info and pricing

Legal data

- Information about any litigation processes

- Legal disputes

- Confidential documents on insurance

- Data about collaboration with law firms

- Articles of incorporation and bylaws

- Key contracts (vendor, customer, employment)

- Litigation history and intellectual property documentation

- Compliance certificates, permits, and regulatory filings

- Confidentiality and nondisclosure agreements

- Shareholder agreements

IT and technology documents

- IT infrastructure maps and software/hardware inventories

- Cybersecurity policies and incident response plans

- Data privacy policies and disaster recovery plans

- Vendor contracts for IT services and licensing agreements

How to prepare a virtual data room for M&A transactions?

In M&A deals, potential buyers need to have access to large volumes of documents as part of the due diligence process. These documents are confidential and include financials, legal statements, sales predictions, and more. All this information should be stored in a highly secure place and the virtual data rooms are a perfect option for file sharing and data management. Here are key steps and tips to structure the virtual data room for M&A transactions:

Step 1: Create a plan for the VDR

Envision how the virtual data room should look before the M&A process begins. The plan should be a rough draft, which will help the seller operate faster and think in advance about the needed sensitive data for the process. Draw this plan using small squares that represent the major files, and under those squares, write down the files that should be added straight away.

Step 2: Assign access to the relevant people

Identify all participants (buyers, sellers, M&A advisors) and assign access rights based on their roles and stages of the deal. Restrict access to sensitive folders to senior management or buyers deeper into due diligence. Set permissions carefully to control viewing, downloading, printing, or sharing capabilities, this will help to minimize the risk of unauthorized data exposure.

Step 3: Create a systemized filing system

A well-organized filing system will help to save a lot of time looking for the right document when needed. Make sure to create a clear filing system with top-level folders (e.g., Financials, Legal, HR, Commercial) and subfolders for specific document types. Also, include a master file with key early-access documents like teasers, NDAs, and a pitch deck.

Step 4: Add relevant and up-to-date documents

Collect all relevant documents needed for due diligence, such as financial statements, contracts, compliance records, intellectual property files, and organizational charts. Use bulk upload features to efficiently add documents to the VDR, ensuring files are current and relevant.

Make sure to update documents in the data room regularly. Outdated documents are not valuable for the M&A process.

Step 5: Continuously engage with the virtual data room

Regularly using the data room means it stays well-organized and aligned with the target company’s workflow. Since critical documents are securely stored in the data room, teams can avoid keeping sensitive files locally, which can also prevent data breaches.

When all the documents are in one place for due diligence, the chances of document duplication are low and the due diligence process gets faster.

Challenges of virtual data rooms for M&A usage

multi-factor authentication for data safety, etc. However, the effectiveness of the data room depends on its organization. Here are the most common issues that may arise when setting up a virtual data room for M&A due diligence:

- Incomplete or unsigned documents. This problem is common both in traditional data rooms and virtual data rooms. If some of the documents required for potential financial transactions are not completed, the deal will be postponed. That’s why double-checking is recommended for seamless collaboration.

- Data overload. Virtual data rooms for mergers and acquisitions usually offer generous cloud storage. But it doesn’t mean uploading files without limits. Having too many irrelevant documents in your virtual data room M&A will inevitably slow down the whole M&A due diligence process.

- Improper permissions. Traditional data rooms provide all the tools that allow the administrator to take full control of access rights. But unlike with physical data rooms, it’s easy to make a mistake. Carefully set up permissions so that all interested parties have access only to the documents they require.

Conclusion

The mergers and acquisitions market is finally awakening after the downward trend caused by the global pandemic. The deal volume is rising, especially across sectors like AI, cloud security, and the oil industry.

So, if you are on the M&A threshold but have concerns about data security and privacy, using a data room can help minimize the risks of data leakage. With tools like virtual data rooms, it is much easier to stay organized, keep sensitive data protected, and ensure a smooth transaction. Hopefully, the information provided here will help you choose a reliable data room provider with robust security.

FAQ

What is an M&A virtual data room?

An M&A virtual data room is a secure online platform used to store, share, and manage confidential documents during mergers and acquisitions. It helps protect sensitive data while streamlining the due diligence process.

What should be included in an M&A data room?

A typical M&A data room should include general corporate records, financial statements, marketing materials, team bios, intellectual property documentation, supplier contracts, and legal information.

What are the steps in M&A?

The main steps in an M&A deal are: evaluation and preliminary review, negotiations and letter of intent, due diligence, deal closing, and post-merger integration.

What makes the M&A deal successful?

Success in M&A often depends on synergy—the idea that the combined value of the merged companies exceeds their individual worths. Strong integration and strategic alignment are also key factors.

What industry has the most M&A deals?

Industries with the most M&A activity include financial services, healthcare, technology, and retail, driven by innovation, market consolidation, and investor interest.