A virtual data room for life sciences is a secure workspace for file-sharing, clinical trials, research, product development, and collaboration within life science industries.

Data rooms support pharmaceuticals, biotech, medical devices, telehealth, nutraceuticals, food processing, cosmetics, personal care, and many other life science industries.

Among use cases, laboratories, companies, and organizations most often use virtual data rooms for capital raising, clinical trials, M&A, and initial public offering (IPO).

Continue reading to know more about how virtual data room can benefit life science organizations.

The best VDR solutions for life sciences

The virtual data room market enumerates over a hundred software vendors. However, some providers offer dedicated features for life science companies. Let’s compare them in the table below.

| Virtual data room provider | Life science industries | Use cases | Top life science features |

| Ideals | Biotech Pharmaceuticals Medical devices Telehealth Food processing Cosmetics Personal care | Clinical trials Biotech licensing & partnering IPO & fundraising M&A Due diligence IP management IP licensing Regulatory communications Corporate file-sharing | Online CAD viewer M&A and due diligence workflows Built-in redaction Multifactor authentication Secure fence view Eight levels of document permissions HIPAA, GDPR, CCPA, ISO 27001 compliance SOC 2 Type certification |

| Intralinks | Pharmaceuticals Biotech Medical devices Healthcare delivery Research and development | Biotech licensing M&A Fundraising Strategic alliances | AI-powered redaction HIPAA and ISO 27701 compliance Experienced customer service Q&A workflows for due diligence |

| Datasite | Biotech Healthcare | M&A Data storage IPO Fundraising Restructuring Licensing | Q&A workflows AI-based file search Due diligence trackers GDPR, CCPA compliance |

| Dealroom | Biotech Pharmaceuticals | M&A Clinical trials Fundraising Strategic IPO Licensing Audits | Four levels of permissions Due diligence trackers Premade due diligence templates HIPAA, GDPR, ISO 27001 compliance |

| Sharevault | Therapeutics Medical devices API biologics | M&AResearch and development Clinical trials Licensing & partnerships Regulatory communications Corporate file-sharing | eCTD viewer Q&A workflows Three levels of non-configurable user permissions FDA Compliance ISO 27001 compliance |

The main benefits of virtual data rooms for life sciences

Recent life science trends shifted toward digital transformation and productivity advancements. Based on Deloitte’s Life Sciences 2023 outlook, biotech companies heavily invest in research despite economic headwinds:

- Product development is the top priority for 80% of medtech executives.

- Workforce development is critical for 90% of biopharma executives.

- Next-gen therapies for patients are very important for 95% of pharma companies.

A surge in discoveries, new therapies, and product development generates increased demand for virtual data rooms.

According to the International Data Corporation (IDC) report, 50% of life science organizations will adopt IT intelligence platforms, including virtual data rooms, by 2024. And this is a predictable outcome, since data rooms simplify business and scientific activities and improve the following business areas:

- Deals management

- Data security and compliance

- Document management

- Due diligence

Let’s now shortly review how exactly each of these areas benefit from virtual data rooms implementation.

Deal management

Although M&A in life sciences followed downward worldwide trends in 2022, some of its sub-industries showed resilience. For instance, the volume of pharmaceutical deals was up 15% compared to the previous year, totaling 92 deals, according to the Deloitte report.

It drives demand for deal management solutions, such as virtual data rooms. Life sciences companies improve deal management with the following VDR capabilities:

- Superb deal analytics. Robust data analytics capabilities provide a bird’s eye view of bidder engagement and deal progress at every stage. You can track deal progress, predict outcomes, and see crucial KPIs on your M&A timeline.

- Secure contract management. Dealmakers view documents and sign contracts in highly protected environments, increasing trust and security. Data rooms also enable custom enforceable NDAs, T&C, and other agreements for better compliance.

- Effortless user management. It’s easy to onboard deal participants, manage their rights, and track their performance. User activity tracking and group management tools allow you to control and channel user performance in response to your M&A needs.

Sensitive data protection and compliance

According to the IBM life sciences industry report, financial losses due to data breaches and cybercrime reached $4.6 billion. Medical device companies reevaluate their tech investments and emphasize security platforms, including virtual data rooms.

VDRs provide life sciences with the following security and compliance benefits:

- Zero-trust infrastructure. Two-factor authentication, password policies, session timeouts, IP restrictions, and granular access permissions minimize human error while handling sensitive documents.

- Secure communication. Remote file control, document permissions, restricted viewing, screen capture blocking, and other features minimize data leaks. Advanced data rooms can also hide confidential documents and selected users, increasing privacy and security within the organization.

- HIPAA, GDPR, and FDA compliance. Most data rooms comply with the General Data Protection Regulation (GDPR), the Health Insurance Portability and Accountability Act (HIPAA), and the U.S. Food and Drug Administration (FDA) standards. Compliant data rooms make ideal environments for clinical trials, biotech product development, and other heavily regulated activities.

Document management

According to KPMG’s M&A cloud data report, over 40,000 companies already benefit from data management solutions, like virtual data rooms. Life sciences businesses and organizations can increase productivity with the following VDR data management tools:

- Bulk confidential information management. Data rooms allow for uploading and downloading unlimited files at 200 Mbps and moving bulk documents across the index using drag and drop.

- CAD file support. Researchers, healthcare professionals, and dealmakers can view CAD software files directly in the data room.

- Automatic index numbering. Auto-indexing reduces data entry tasks, helping clinical research firms focus on medical outcomes, studies, and product development.

- Full-text search. Data rooms enable file search using keywords and filters. Optical Character Recognition (OCR) search allows for locating textual content in images and PDF files.

Due diligence

According to Morgan Lewis’s findings, life science companies blend traditional M&A with partnerships and spinoffs to reduce research and development risks.

These transactions require a thorough and risk-free due diligence process, and companies can conduct one in secure virtual data rooms due to the following capabilities:

- Built-in document redaction. Advanced redaction tools allow you to quickly remove the most sensitive information from bulk documents before due diligence.

- Q&A workflows. Life science dealmakers can consult each other during due diligence and involve subject-matter experts using dedicated workflows.

- Due diligence tracking. Data rooms allow deal parties to assign document reviewers, track review progress, and manage due diligence checklists.

How do life science companies use virtual data rooms?

Below, you can discover several case studies on the main use cases of virtual data rooms for life sciences, including the following:

- Capital raising

- Clinical trials

- Biotech M&A

- Initial public offering (IPO)

Capital raising

According to Bloomberg, biotech companies face significant challenges while attracting money in 2023. In 2020, private capital raising dipped 19%, and 2023 will likely be no different.

As a result, biotech fundraising requires many simultaneous investor communications, trust-building, and professional approaches. And this is significantly simplified when using virtual data rooms. This is what biotech startups can achieve with the help of VDRs:

- Invite multiple investors to separate data room projects with unique privacy rights

- Maintain communication in a highly secure, branded environment to build trust and reassure investors

- Share confidential data without risking privacy due to granular user permissions and document security controls

- Sign agreements directly in the data room and maintain a complete audit trail of investor communications

- Overview time spent on each document due to drill-down reports and detect potential investors’ specific interest

| Example: Tubulis, a German biotech startup that produces uniquely matched protein-drug conjugates for cancer treatment, used Ideals virtual data room to raise €60 million in 2022. This company multiplied success chances by inviting several investors and regulatory advisors to separate data room projects. |

Clinical trials

Based on the RSM life sciences outlook, over 5,200 clinical trials started in 2022, while researchers around the globe currently conduct over 16,000 studies.

Clinical trials produce large volumes of critical data and often involve third parties. Research findings, patient data, personal data, and other valuable information requires complete control under GDPR, HIPAA, HITRUST, and FDA standards.

Unlike general collaboration platforms, virtual data rooms allow researchers to have much stricter control over sensitive information:

- Decide how many users, how, and when they access data during clinical trials

- Meet strict medical data protection standards

- Work with research findings in a central repository

- Collaborate and track research communications inside the data room using Q&A workflows, messaging tools, tasks, comments, and discussions

- Share research findings with strategic partners to support and develop clinical trials

| Example: SyneuRx, a Taiwanese biotech company, successfully used the Ideals virtual data room for clinical trials. In 2022, this company shared COVID-19 research findings with American, European, and Chinese partners in several secure life science projects. |

Biotech M&A

PWC, the second-largest M&A consulting firm, concludes that tech-powered due diligence largely contributes to successful biotech M&A deals.

The consulting giant says real-time, automated due diligence insights help deal parties timely respond to challenges and make informed decisions. Data rooms provide various functionalities that make this possible and enable life sciences organizations to:

- Speed up contract reviews during due diligence

- Respond timely to due diligence requests via Q&A workflows

- Grant and revoke access to sensitive data at any time

- Negotiate deal terms and sign agreements directly in the secure data room

- Use customizable roles and task workflows to supervise and coordinate collaboration between departments during post-merger integration

| Example: Sartorius, a Germany-based pharmaceutical laboratory and laboratory equipment supplier, used Datasite virtual data room to acquire Albumedix for $501 million in 2022. Sartorius successfully leveraged contract review tools to expand its portfolio of viral therapies and vaccines. |

Initial public offering (IPO)

According to BDO, an international accounting firm, life science IPO peaked in 2021 at 104 deals and fell to only 22 deals in 2022. While 2023 may see more IP licensing agreements, 64% of life science investors expect an IPO rebound in 2024.

Interestingly, only 28% of investors expect life science IPO to recover by the end of 2023, while others call this year a “bellwether.” If 2023 sees successful IPOs, the market may show strong growth in the next year.

To conduct successful IPOs, many life science companies use virtual data rooms as they allow the following:

- Create a digital IPO timeline with tasks, milestones, and KPI tracking

- Manage agreements and patent contracts in a centralized platform

- Address ongoing challenges timely due to smooth workflows with dedicated roles, approval mechanisms, and accountability tools

- Manage regulatory communications and reporting due to customizable reports and audit trails

| Example: Royalty Pharma, the largest buyer of pharmaceutical royalties, used Intralinks data room to go public in 2020. The company successfully managed SEC communications and invited several advisors to a centralized data room. The IPO was valued at $2.2 billion. |

What to include in your life science virtual data room?

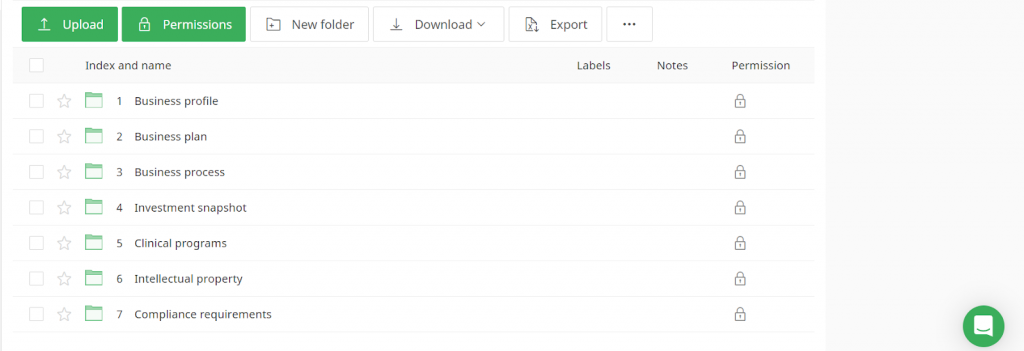

Virtual data rooms may have different structures based on use cases and requirements. However, any life science data room generally contains the following folders:

- Business profile

- Business plan

- Business process

- Investment snapshot

- Clinical programs

- Intellectual property

- Compliance requirements

Let’s now briefly review what to include in each folder.

1. Business profile

The business profile or corporate overview folder may contain documents on the company and the team behind it, including but not limited to the following:

- Company profile. The mission statement, background, corporate culture, main products, markets, etc.

- Corporate structure. Organizational chart, legal policies, procedures, etc.

- Company team profiles. Owners, founders, advisory boards, and executive leadership.

- Financial profile. Financial status, five years of financial statements, annual budgets, etc.

It would be wise to continuously update this info to be due-diligence-ready in case of M&A, fundraising, and other projects.

2. Business plan

The business plan or commercial strategy folder should encompass the company’s commercial strategy and business development, including the following:

- Market research. SWOT analysis, market analysis, including customers and trends.

- Competitive analysis. SWOT analysis, sales and revenue analysis, product comparisons, regulatory analysis, leadership overview, marketing information, etc.

- Commercial forecasts. Financial projections based on historical performance and current financial status.

- Marketing strategies. Advertising strategies, promotion techniques, customer relations, branding guidelines, social media information, and up-to-date marketing performance.

- Sales information. Sales model, pricing model, including product lines and promotions.

3. Business process

The business process and manufacturing folder should center around your firm’s production and facilities and contain the following information:

- Research and development. Clinical protocols and procedures, research plans and proposals, laboratory agreements, FDA submissions, etc.

- Quality control. Quality agreements with suppliers, product quality and stability studies, equipment maintenance records, process validation data, etc.

- Project management. Project charters and plans, status reports, project change requests, resource plans, etc.

- Supply chain. Supplier contracts, purchase orders, inventory records, compliance and EHS documentation, supplier performance reports, etc.

- Business continuity. Business continuity, disaster recovery, emergency response, crisis communication plans, etc.

4. Investment snapshot

An investment folder will help biotech startups, sellers, and acquirers prepare for smoother and faster transactions. The investment overview folder should focus on investment documents at every due diligence stage and contain the following info:

- Investment strategies. Detailed info on portfolio diversification strategies, investment goals, etc.

- Investor presentations. Previous and current investor pitches, including approved and pending.

- Funding rounds. Detailed info on previous, current, and planned funding rounds.

- Legal documents. Shareholder agreements and resolutions, articles of association, board resolutions, term sheets, investor communications, etc.

5. Clinical program

The clinical program overview folder should contain data on your firm’s clinical studies, including but not limited to the following:

- Standard operating procedures. In-vivo and in-vitro protocols, laboratory management and study initiation procedures, etc.

- Clinical studies and reports. Clinical trial and study approval protocols, pharmacology and safety reports, pharmacokinetics and pharmacodynamics reports, etc.

- Drug information. Chemistry, manufacturing, and controls (CMC) data, development, stability, formulation reports, administration protocols, etc.

- Risk assessment. Quality assurance and risk assessment documentation.

This section may include subfolders, including the pre-clinical program folder and clinical program folder to differentiate pending, approved, and completed reports and studies.

6. Intellectual property

The intellectual property folder should center around patents, intellectual property rights, and supporting documents, including but not limited to the following:

- Patents. Granted patents, pending patents, patent applications, patent assignments, licensing agreements, patent litigations, etc.

- Trade secrets. Trade secret policies and NDAs, disputes, and other legal documents.

- Trademarks and copyrights. Search reports, applications, registrations, etc.

- Legal documents. Patent estate, licensing agreements of trademarks, copyrights, related litigations, proposals, and other documents.

7. Compliance requirements

The regulatory folder should focus on procedures and standards regarding clinical trials and business processes and contain the following info:

- Regulations and standards. FDA, EMA communications, New Drug Applications (NDAs), Good Laboratory Practices (GLP), Good Clinical Practices (GCP), etc.

- Policies and procedures. Health and safety, research and development, quality management, and other policies.

- Inspection documentation from regulatory agencies. Investigational New Drug (IND) applications, Medical Device Single Audit Program (MDSAP) audits, corrective action plans, etc.

- Certifications. HIPAA and HITRUST certificates, DSMB approvals, and accreditations from other organizations.

- Complaints. Adverse event reports, trial participant complaints, protocol deviation reports, etc.

Key takeaways

Data rooms for life sciences provide dedicated tools to streamline clinical trials, licensing, capital raising, M&A transactions, and other activities in the industry.

Virtual data rooms improve deal management, data security, compliance, document management, and due diligence. They can save pharmaceutical companies from data breaches, simplify investor communications, follow compliance standards, and more.

The virtual data room market enumerates over 100 providers. However, Ideals, Intralinks, Datasite, Dealroom, and Sharevault provide the most helpful features for life science companies.

If you plan to use a data room for your firm and are thinking of what to include, start with these folders: the business profile, business plan, business process, investment snapshot, clinical programs, intellectual property, and compliance requirements.

FAQ

What is a data room for life sciences?

A data room for life sciences is a secure and compliant workspace with dedicated life science features, like CAD file support, workflows, and role-based access.

What should a life science data room include?

A life science data room should contain at least the following folders:

- ✅ Business profile

- ✅ Business plan

- ✅ Business process

- ✅ Investment snapshot

- ✅ Clinical programs

- ✅ Intellectual property

- ✅ Compliance requirements

What should be in the data room for due diligence?

The diligence process for life science companies should cover the following:

- Intellectual property portfolio

- Financial statements

- IT technology

- Legal documents

- Environment & health & safety documents

- Tax documents

What are data room activities?

A life science data room involves document storage, data sharing, collaboration, messaging, contract review, due diligence, agreement signing, and other activities.