Despite a slow start to 2025 due to changing trade dynamics and regulatory changes, the Canadian M&A market is expected to remain active. The PWC report indicates there’s still plenty of private equity funding and energy, tech and healthcare are hot sectors. But dealmakers need to be nimble and adapt to regulatory changes and geopolitical risks.

In such a complex landscape, M&A operational due diligence (ODD) is a safety net for Canadian investors and acquirers. This article breaks down:

- What ODD really is, and why it’s different from financial or legal due diligence

- Key frameworks & checklists to streamline your assessments

- ODD’s growing role in private equity

- How virtual data rooms (VDRs) are transforming ODD efficiency in Canada

What is Operational Due Diligence?

Deloitte’s ODD overview defines operational due diligence as a detailed and systematic review of a company’s operations. This is done by a potential buyer or investor during mergers and acquisitions, private equity investments or capital raisings.

ODD reduces uncertainty, reveals risks, supports valuation and increases the chances of a successful transaction and post-deal integration. As a rule, operational due diligence services are provided by teams within investment firms or by external consultants with expertise in operations, finance and industry-specific practices.

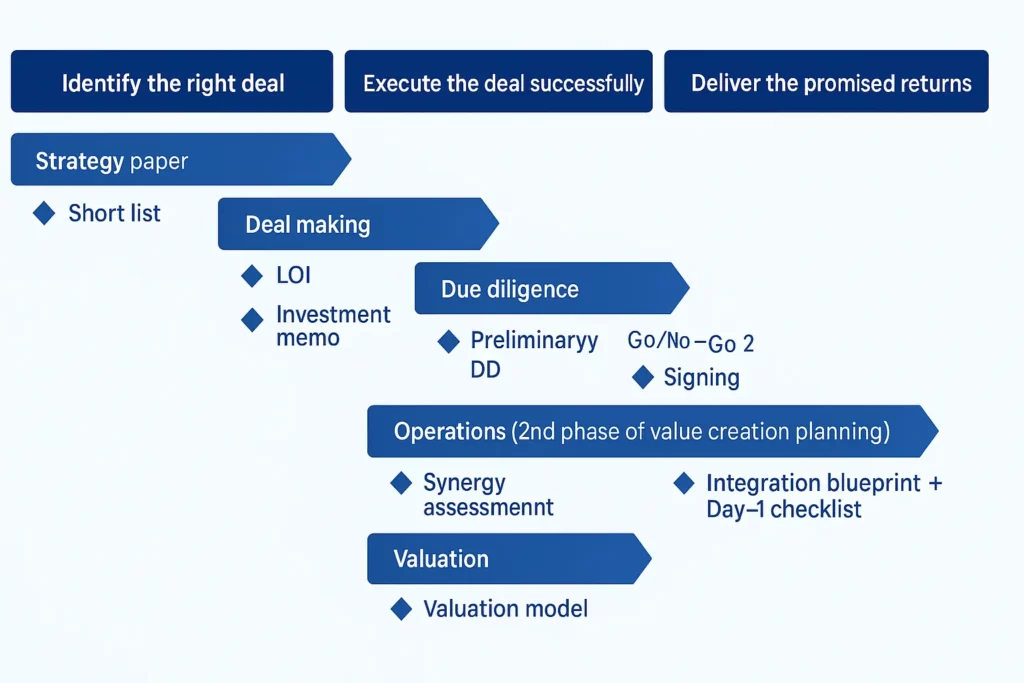

Deloitte’s overview says ODD is an ongoing process. It doesn’t stop after due diligence. Operational due diligence starts during the target selection phase and continues through the deal cycle up to and including the first 100 days after the deal is closed.

The main objectives of operational due diligence are to:

- evaluate how well the company’s operations support its business model and strategic objectives;

- identify potential operational risks;

- explore areas for operational improvements;

- uncover value-creation opportunities;

- ensure the sustainability and scalability of the business after a transaction;

- validate the achievability of the business plan with existing resources and capital expenditure.

- create a realistic, scalable business plan for post-acquisition integration and growth.

Types of due diligence

Here, we compare operational due diligence with legal and financial due diligence activities:

| Aspect | Financial due diligence (FDD) | Legal due diligence (LDD) | Operational due diligence (ODD) |

|---|---|---|---|

| Focus Area | Financial statements, revenue, profitability | Contracts, litigation, regulatory compliance | Processes, systems, workforce, supply chain |

| Primary Goal | Validate financial health & valuation | Identify legal risks & obligations | Assess operational efficiency & scalability |

| Key Questions | “Are the numbers accurate?” | “Are there legal liabilities?” | “Can operations support growth?” |

| Common Tools | Audits, financial modeling | Contract reviews, regulatory checks | Process mapping, KPI analysis, site visits |

| Relevance in Canada | Critical for deal valuation | Ensures compliance with Canadian laws | Mitigates risks in regulated industries (e.g., energy, fintech) |

Operational due diligence framework

A robust operational due diligence framework helps confirm whether a company can scale, comply with local laws, and compete effectively. In Canada, where regional regulations, bilingual requirements, and U.S. trade ties add extra layers of complexity, a well-rounded ODD process is a must for confident investment decisions. Here’s what a standard operations due diligence framework should include:

1. Operational strategy review

The goal of this review is to identify operational risks that may impact long-term success. For example, in the case of hedge fund failures, operational mismanagement can affect returns and investor confidence. The review covers the following aspects:

- Business model alignment with long-term goals

- Market positioning and competitive advantages

- Scalability across Canada’s diverse regions (e.g., resource-heavy Alberta vs. tech-driven Ontario/Quebec)

2. Organizational structure & leadership

Leadership stability is critical, especially in industries like mining and energy, where long-term projects dominate. Here are the crucial areas for due diligence:

- Management depth, expertise, and succession planning

- Corporate culture and employee engagement

- Labor relations (e.g., unionized workforces in manufacturing, transportation)

- Management depth, succession planning, and corporate culture.

3. Core process mapping & efficiency analysis

Cross-border logistics (U.S./Canada) and bilingual operations (e.g., Quebec’s French-language requirements) add complexity. It covers:

- Workflow bottlenecks and operational inefficiencies

- Supply chain risks (e.g., cross-border delays, supplier concentration)

- Cost structure analysis (fixed vs. variable costs)

4. Risk & compliance systems

Strict provincial/federal laws (e.g., Quebec’s Bill 64 for data protection) require rigorous compliance checks. The review includes:

- Regulatory compliance (PIPEDA for data privacy, CASL for anti-spam, Quebec’s Bill 64)

- Internal controls, fraud prevention, and audit readiness

- Environmental, health, and safety (EHS) compliance

5. Technology & infrastructure audit

Cyber threats and digital transformation demands, such as fintech regulations under OSFI, make tech due diligence critical. Here are the key components of IT due diligence:

- IT security (cyber risk, data protection)

- Software scalability (ERP, CRM systems)

- Legacy system risks and digital transformation readiness

Operational due diligence checklist

Diverse regulatory environment, regional market variations, and the need to navigate both federal and provincial laws make Due diligence in Canada a complex process. This ODD checklist is a must-have for investors, private equity firms, and M&A professionals who are looking for a clear, risk-aware view of the target company’s operations.

1. Business operations & processes

- Review core business operations and workflow efficiency

- Assess production capacity, bottlenecks, and scalability

- Evaluate supply chain robustness (suppliers, logistics, lead times)

- Analyze inventory management and turnover rates

- Examine procurement processes and cost controls

- Review key operational policies and standard operating procedures (SOPs)

2. Regulatory & compliance

- Verify compliance with Canadian federal, provincial, and municipal regulations

- Assess environmental, health, and safety (EHS) compliance

- Review permits, licenses, and industry-specific certifications

- Check for past or pending regulatory violations or fines

- Evaluate data privacy and cybersecurity compliance (PIPEDA, GDPR if applicable)

3. Financial & cost structure

- Analyze operational cost structure (fixed vs. variable costs)

- Review historical and projected CAPEX/OPEX trends

- Assess working capital requirements and cash flow cycles

- Identify cost-saving opportunities or inefficiencies

4. Human resources & workforce

- Review organizational structure and key personnel

- Assess labor relations, union agreements (if applicable), and employee turnover

- Verify compliance with employment standards (ESA, human rights, pay equity)

- Evaluate talent retention strategies and training programs

5. Technology & IT infrastructure

- Assess enterprise software and IT systems (ERP, CRM, cybersecurity)

- Evaluate IT disaster recovery and business continuity plans

- Review technology scalability and digital transformation readiness

6. Customer & vendor relationships

- Analyze customer concentration risks and contract stability

- Evaluate vendor/supplier dependencies and contractual terms

- Review service-level agreements (SLAs) and performance metrics

7. Risk management & contingency planning

- Identify key operational risks (supply chain, geopolitical, natural disasters)

- Review insurance coverage adequacy (liability, property, business interruption)

- Assess crisis management and contingency plans

8. ESG & sustainability practices

- Evaluate environmental sustainability initiatives (carbon footprint, waste management)

- Review corporate social responsibility (CSR) programs

- Assess governance practices and board oversight

Areas of operational due diligence

Operational due diligence takes a close look at how a company runs its daily operations. The goal is to spot any risks, make sure the business plan makes sense, and find ways to improve or grow the business. It usually focuses on these key areas:

1. Management and organizational structure

ODD begins with an overview of who’s running the company and how the organization is set up. Strong leadership and a clear structure are essential for stability and long-term success.

- Leadership experience and track record

- Decision-making processes and governance

- Organizational design, roles, and reporting lines

- Talent capabilities, retention, and succession planning

- Corporate culture and employee engagement

2. Operational processes

Next, it reviews how daily operations work in practice. This includes how efficiently the company produces goods or delivers services, and whether there are any weak points or chances to improve.

- Efficiency and effectiveness of workflows and production lines

- Quality control systems and compliance with standards

- Asset utilization and maintenance

- Bottlenecks and operational constraints

- Cost drivers and operational scalability

3. Technology and IT infrastructure

Technology plays a major role in supporting operations, so ODD checks whether systems are reliable, secure, and able to grow with the business.

- Reliability and scalability of IT systems

- Cybersecurity measures and data protection protocols

- Potential integration challenges and technology adaptability

- Software platforms supporting operational reports

4. Supply chain and vendor management

A company depends on its suppliers and logistics partners. This part of the review looks at how stable those relationships are and how well the supply chain handles pressure.

- Stability and reliability of key suppliers

- Supply chain risk mitigation strategies

- Procurement processes and contract terms

- Logistics efficiency and inventory management

5. Financial controls and operational financial performance

Beyond the usual financial review, ODD looks at how well the business manages money in day-to-day operations. It helps reveal if costs are under control and if performance matches financial expectations.

- Accuracy and timeliness of financial reporting related to operations

- Cost structure analysis and cash flow sustainability

- Key performance indicators (KPIs) tied to operational efficiency

- Asset condition and capital expenditure requirements

6. Regulatory compliance and risk management

Canadian businesses face strict regulations depending on their industry and location. ODD checks how well the company handles compliance, risk, and readiness for unexpected events.

- Adherence to industry-specific regulations and standards

- Internal controls and audit trails

- Legal risks and pending litigation related to operations

- Business continuity, disaster recovery, and risk mitigation plans

7. Customer and supplier relationships

A strong customer and vendor base is key to a company’s stability. ODD explores how dependent the company is on certain clients or partners, and whether those relationships are secure.

- Contract dependencies and renewal risks

- Customer concentration and loyalty

- Supplier collaboration and dependency on key personnel

8. Integration and post-deal readiness

Finally, it assesses how easily the business can integrate with a buyer. This includes how well systems and teams will fit together, and whether the deal will deliver long-term value.

- Compatibility of operational systems and processes with the acquirer

- Cultural fit and change management readiness

- Identification of synergies in M&A and integration risks

Types of operational due diligence

Based on the side of the private equity deal, there are two types of operational due diligence: buy-side and sell-side. Here are key areas for buy-side vs sell-side of the deal and why they matter:

Key focus areas for Canadian buyers:

- Operational readiness: Can the business integrate smoothly post-acquisition?

- Scalability: Are processes efficient enough to support growth (e.g., expansion into Quebec or U.S. markets)?

- Synergy potential: Where can operations be merged or optimized (e.g., shared services, tech stack consolidation)?

- Hidden liabilities: Compliance gaps (e.g., PIPEDA, Quebec’s Bill 64), supply chain risks, or outdated infrastructure.

Since each region has its own rules, like employment laws in Ontario or energy regulations in Alberta, buyers need to dig deeper during the ODD. For example, a private equity firm in Toronto looking at a factory in Manitoba would need to check things like whether the workforce can support French-speaking markets and if energy costs are manageable long-term.

Key focus areas for Canadian sellers:

- Process optimization: Streamline workflows to boost valuation (e.g., automate manual reporting).

- Compliance cleanup: Resolve issues like CASL violations or incomplete ESG disclosures.

- Financial/operational alignment: Ensure KPIs reflect stability (e.g., low customer churn in SaaS).

- Commercial readiness: Can operations withstand buyer scrutiny without last-minute fire drills?

Sellers who prepare for operational due diligence early have a better shot at attracting strong offers. In places with unique laws, like Quebec or Vancouver, sellers often need to make adjustments before the deal. For example, a Vancouver tech startup getting ready for sale would need to document its data privacy policies to comply with PIPEDA and Bill 64, and audit its cloud infrastructure to ensure cybersecurity is up to par for potential buyers.

| Type | Purpose | Focus Areas | Outcome |

|---|---|---|---|

| Buy-side ODD | Evaluate target’s operations for investment or acquisition | Operational readiness, scalability, risks, synergies | Informed purchase decision, risk mitigation, integration planning |

| Sell-side ODD | Prepare target company for sale | Fix operational gaps, improve processes, compliance | Enhanced seller readiness, improved valuation, smoother due diligence |

Operational due diligence and private equity

Private equity operational due diligence looks for ways to improve a company’s operations to increase its value and profitability over time. The scope and pressure differ from traditional due diligence. This is because PE firms must validate growth assumptions, identify efficiency gains, and ensure capital readiness before investing.

PE firms face more pressure to move fast, forecast returns accurately, and squeeze efficiency from every part of the business. That’s why their ODD process digs deeper into things like:

- what drives revenue

- where costs can be trimmed

- whether the company can scale with the right people and tools in place.

They also focus on evaluating whether the target company’s operations can support their ambitious growth goals. This includes assessment of the current leadership, IT systems flexibility, and how much investment will be needed post-acquisition. PE firms like OMERS Private Equity and CDPQ take this approach seriously. They aim not just to buy companies, but to make them stronger and more competitive over time.

Objectives of operational due diligence

Operational due diligence aims to validate the business plan, manage operational risks, and make sure the company is ready for growth. Here are the main objectives of operation due diligence in more detail:

1. Business plan validation

ODD assesses whether the target operational model of a target company can actually support its stated business plan and strategic objectives. To assess this, due diligence teams analyze target company workflows, key performance indicators, and the ability to execute growth strategies or realize synergies post-transaction.

If applicable, investors can build simulation models to test how the business will perform in the future. They might check what happens if the company grows quickly or becomes part of the buyer’s operations. These models show whether the team, systems, and processes can handle the changes. This helps investors see if the business plan makes sense and if the company is ready for the next step.

2. Risk management

Risks include supply chain vulnerabilities, technology gaps, management weaknesses, or compliance failures. Identifying risks early helps you create a plan to manage them and reduces the likelihood of costly surprises after the deal is done.

3. Operational readiness for growth

Investors and private equity firms want to know that a company’s operations can actually support its future growth. And that means looking at the efficiency of its processes, the strength of its IT systems, the quality of its management team and the physical and human capital it has on hand. When reviewing a company’s operational readiness, investors identify where it’s already doing things well and where it needs to improve.

4. Regulatory compliance

Regulatory compliance In industries like healthcare, finance and mining, Canadian regulations are very strict. Non-compliance can be expensive. To avoid this, due diligence teams review the company’s compliance with industry-specific laws and regulations. That might include healthcare privacy rules (HIPAA), financial regulations, or environmental and safety standards in mining. Checking compliance with regulations helps to avoid costly legal risks and operate without regulatory impediments after the transaction.

Improve operational due diligence process with virtual data rooms

Virtual Data Rooms (VDRs) enhance the operational due diligence process. They provide a secure, efficient, and collaborative platform to manage and review large volumes of sensitive documents. Here’s how exactly due diligence data rooms improve ODD for businesses:

Better data security and access control

Data rooms offer granular permission settings, two-factor authentication, dynamic watermarking, and detailed audit trails. These features ensure that only authorized users access confidential operational documents.

Efficient document management

VDRs allow for instant access to a well-organized repository of documents, they support multiple file formats, full-text search, indexing, and automated folder structures. This streamlines the review process and saves time compared to physical or less sophisticated digital solutions like Google Drive.

Comprehensive activity tracking and reporting

Data room administrators can monitor user activity in real time, track which documents have been viewed or edited, and generate detailed operational due diligence reports. This visibility helps identify buyer priorities and manage the diligence workflow more effectively.

Better collaboration between the deal parties

Features like integrated Q&A modules, commenting, and messaging enable seamless interaction among due diligence teams, sellers, and advisors. It helps teams spot problems faster and make decisions more quickly.

Cost and time savings

VDRs keep everything digital, so there’s no need for printing, travel, or handling physical documents. This saves time, cuts admin costs, and helps move due diligence along faster. And, since the entire due diligence process happens online, deal parties can access and collaborate at any time and from anywhere. A great benefit for cross-border business transactions.

Top 3 virtual data room solutions for operational due diligence

There are over 100 VDR providers on the market, and not all of them fit the purposes of ODD. Here, we have gathered the top 3 data room providers that are commonly used for operational due diligence. These private equity data rooms are SOC 2 certified, which is critical for Canadian data privacy laws and offer advanced features to speed up due diligence:

| Provider | Best For | Key ODD Features | Canadian Advantage | Pricing (Est.) |

|---|---|---|---|---|

| Ideals Visit Website | Mid-market to large M&A/PE |

| Superior bilingual (FR/EN) support for Quebec deals | Custom quotes |

| Datasite | Enterprise deals (energy, mining) |

| Strong in resource sectors (Alberta/BC) | Premium tier |

| Firmex | Private equity & legal teams |

| Cost-effective for repeat transactions | Budget-friendly |

Conclusion

Operational due diligence is a key part of evaluating a company’s operations and identifying risks before a deal closes. For companies in Canada, it’s even more important due to the complexities of regulatory compliance, ESG and PIPEDA. These can have a big impact on a company’s operational integrity and long-term success.

To do operational due diligence, companies use virtual data rooms. A virtual data room is operational due diligence software that makes document management more secure, transparent and collaborative. Leading VDR providers like Ideals, Datasite and Firmex have features that cater to the specific needs of operational due diligence in the Canadian and global M&A markets. These tools allow investors and firms to manage sensitive information, review operational areas and make informed decisions.