Mergers and acquisitions (M&A) are the engine of growth, transformation and competitive advantage for Canadian businesses. At the heart of successful M&A deals is the concept of synergies. It is the value created when two companies merge together.

According to the M&A market report, the business landscape in Canada is marked by digital transformation, regulatory changes, and economic uncertainty. In such a hectic environment, synergies in M&A can make or break an M&A deal. That’s why M&A data rooms have become key tools to evaluate, plan, and track synergy opportunities in real time. Here, we explore how virtual data rooms (VDRs) help ensure that projected synergies turn into measurable results.

What are synergies in M&A?

Synergies in M&A are the tangible and intangible benefits realized when two firms merge or one acquires another. This means the combined entity is more valuable, operationally efficient, and strategically positioned than the companies operating separately. For example, if Company A is valued at $300 million and Company B at $150 million, but together they are worth $500 million. The $50 million difference is the synergy created by the merger.

This value can come from:

- Cost savings (eliminating redundancies, optimizing supply chains).

- Revenue growth (cross-selling products, entering new markets).

- Strategic advantages (enhanced R&D capabilities, stronger competitive positioning).

Realised vs. projected synergies

There are realized and projected synergies in M&A. Here is how they differ:

| Projected Synergies | Realised Synergies |

|---|---|

| Estimated pre-deal based on due diligence. | Actual synergies achieved post-merger. |

| Often used to justify deal premiums. | Measured through financial performance. |

| May be optimistic (subject to execution risk). | Can fall short due to integration challenges. |

- Overestimation (unrealistic cost-cutting or revenue assumptions).

- Integration failures (cultural clashes, operational delays).

- External factors (market shifts, regulatory hurdles).

In fact, synergies directly impact M&A valuation and negotiations. Buyers often pay more than what the target company is worth on its own. They expect that the merger will lead to financial benefits, cost savings, or market expansion.

These potential benefits are built into financial models like Discounted Cash Flow (DCF) and Accretion/Dilution analysis to estimate future value and check if the deal will grow earnings. If the forecasted gains are strong, buyers may even take on more debt to fund the deal. After the merger, investors watch closely to see if the company delivers on those potential synergies, because that’s what justifies the price they paid.

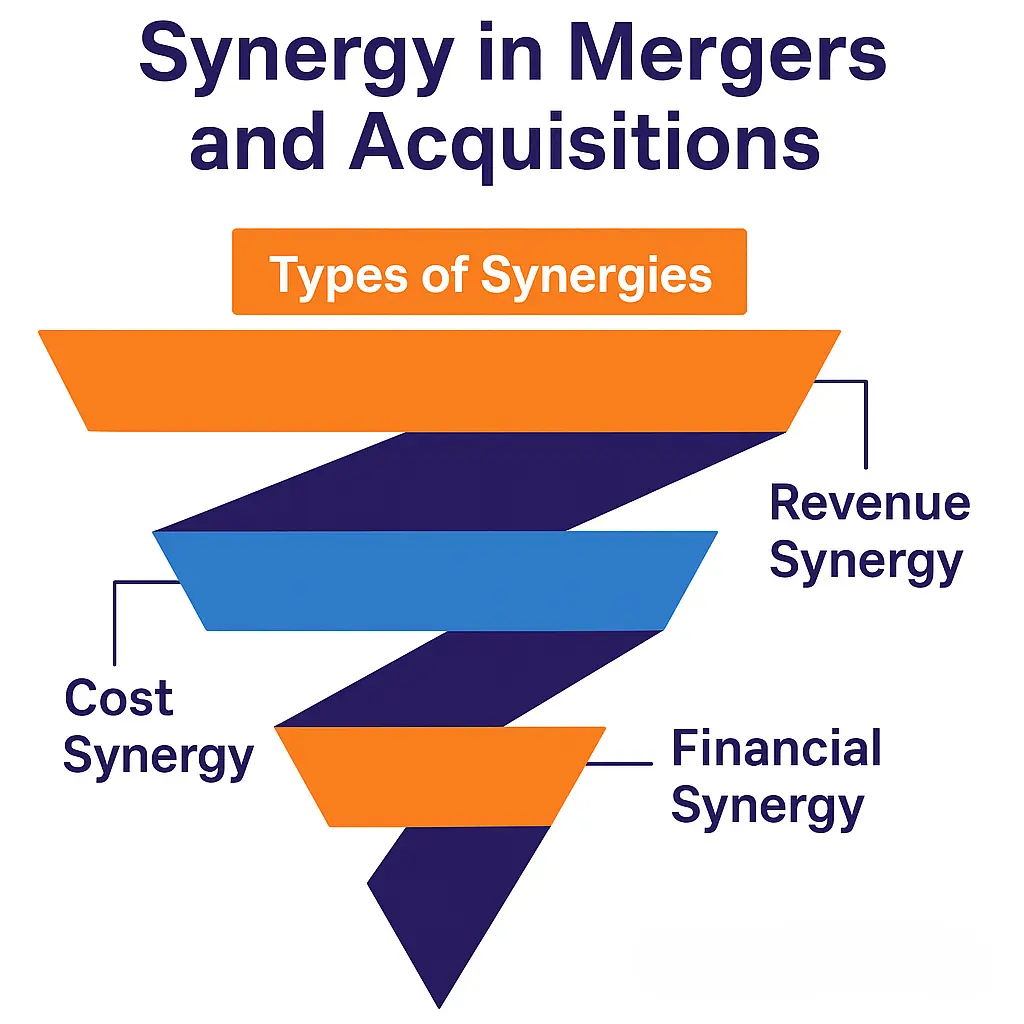

Types of synergies in M&A

Not all synergies are the same. Some save money, others drive growth. Below are the main types of synergies in M&A that everyone involved, from investors to integration and sales teams, should understand.

Cost synergies

Cost synergies are achieved when the merger leads to cost reductions or operational efficiencies. These are often considered the most tangible and easiest to realize. Common sources of cost synergies include:

- Eliminating duplicate functions or roles (consolidating management teams)

- Sharing resources such as R&D, supply chains, or marketing channels

- Reducing overhead costs like rent or logistics

- Achieving economies of scale in procurement and production

Revenue synergies

Revenue synergies occur when the combined companies can generate more sales than they could separately. This can result from:

- Cross-selling products to each other’s customer bases

- Expanding into new markets or geographies

- Leveraging complementary products or services

- Accessing new intellectual property or patents to create innovative offerings

Financial synergies

Financial synergies arise from improvements in the financial position of the merged firm, such as:

- Better capital structure and access to financing

- Increased debt capacity or lower cost of capital

- Tax benefits from combining operations or leveraging losses

Operational synergies

Operational synergies happen when two companies combine their day-to-day activities in a way that makes things run more smoothly and efficiently. These include:

- Shared R&D leading to faster innovation

- Optimized manufacturing/supply chain processes

- Technology integration (merging IT systems for scalability)

Managerial synergies

Managerial synergies come from merging the expertise and strategic thinking of leaders from two companies. Some examples of this type of synergy are:

- Retaining top talent from both firms

- Better decision-making with combined management insights

- Strategic realignment, like pivoting to high-growth sectors

Why synergies matter in Canadian M&A deals

Creating synergies is one of the central reasons why Canadian companies pursue mergers and acquisitions. This is the key to unlocking value that neither party could achieve alone. For Canadian businesses, synergies often drive deal rationale, shape integration strategies, and determine whether a transaction ultimately succeeds or fails. Here are some common synergy drivers for Canadian deals:

Cross-border expansion

Canada’s mid-sized economy pushes firms to seek growth in the US/EU. Cross-border deals can yield revenue synergies through broader market access and cost synergies.

Synergies come from combining distribution networks, customer bases, and regulatory knowledge. Shopify’s Acquisition of Deliverr illustrates this point. The acquisition helped Shopify deliver orders faster in the U.S. using Deliverr’s logistics.

Regulatory efficiency

M&A can help firms navigate Canada’s complex regulatory environment, especially in highly regulated sectors like banking and energy. When two companies join forces, they can cut down on compliance costs and get products to market faster.

For example, the Rogers-Shaw Merger deal helped two companies share spectrum licenses and lower regulatory costs after merging. It also allowed Rogers to expand its 5G network and strengthen its position in Western Canada. At the same time, they reduced overlap in infrastructure and operations.

Resource sector consolidation

In mining, oil & gas and related industries, consolidation is a long-standing trend. M&A allows companies to pool assets, optimize production, share infrastructure and reduce exploration risk. This yields operational synergies and better capital efficiency.

The merger between Equinox Gold and Calibre Mining is an example of how resource sector consolidation drew operational synergies. The combined entity will increase annual gold production, streamline exploration and reduce costs. This puts the merged company as a major player in the global gold mining space.

Challenges in realising M&A synergies

While synergies drive M&A value, many deals fail to achieve projected benefits due to critical hurdles. Some of the main challenges Canadian businesses must navigate include:

Overestimated synergy assumptions

Sometimes, acquirers get overly optimistic and stretch the future cash flows to justify paying a high price. In other cases, synergy estimates are rushed or based on surface-level data, without truly understanding how the businesses operate day to day. And even when the research and development efforts are solid, unexpected changes, like economic slowdowns, new regulations, or supply chain issues, can throw everything off.

How to avoid it:

- Be realistic. Use data from past deals in your industry to keep expectations grounded.

- Plan for surprises. Run different scenarios to understand the full range of outcomes.

- Tie payouts to performance. Use earn-outs or contingent payments that only kick in if synergies actually happen.

Cultural mismatches and integration issues

Even when the numbers look great, culture clashes can quietly derail a deal. Different work styles, leadership approaches, or company values can lead to tension.

How to avoid it:

- Check the cultural fit early. Use surveys and interviews to spot potential issues before the deal closes.

- Build a joint team. Bring people from both companies into the integration process to build trust and cooperation.

- Communicate clearly. Set expectations early with honest updates, clear timelines, and job security info.

Poor data transparency during due diligence

If you can’t see the full picture before the deal closes, surprises are almost guaranteed later. Sometimes, sellers don’t disclose key risks or inefficiencies. In other cases, important data, like customer contracts or IT systems, sits in silos and gets overlooked. And when M&A due diligence is rushed, red flags often slip through. This lack of clarity can throw off key metrics like combined net income or combined operating expenses and hurt the deal’s success.

How to avoid it:

- Use virtual data rooms to keep all financial, legal, and operational information in one secure place.

- Bring in outside experts. Let third-party auditors double-check the most important data.

- Incorporate AI-powered platforms that can flag unusual patterns in the numbers before they become problems.

How virtual data rooms help maximise synergies

Virtual data rooms keep everything organized and make it easier to work together from start to finish of the M&A process. Here’s how an M&A data room helps maximize synergies at different stages of a deal:

| Area | How VDRs Help | Synergy Impact |

|---|---|---|

| Due Diligence | Centralized, secure access to financials, legal documents, and IP. Structured folders and search tools speed up review. | Informed decisions about cost savings, overlaps, and growth opportunities. |

| Post-Merger Integration (PMI) | Shared space for post-merger integration plans, task tracking, and cross-team communication. | Faster alignment of systems, operations, and teams. Reduced downtime. |

| Real-Time Collaboration | Stakeholders access and comment on files in real time. Role-based permissions protect sensitive data. | Increased efficiency and transparency in communication. Fewer delays in execution. |

| Audit Trail & Compliance | Automatic tracking of document views, downloads, and edits. Helps with legal and regulatory compliance. | Reduces risk and ensures accountability during key phases. |

| Data Security & Access Control | Bank-grade encryption, multi-factor authentication, and granular access settings. | Protects sensitive information while allowing controlled sharing. |

Best practices for capturing synergies in M&A

To get the most value from a merger or acquisition, Canadian companies need to make the most of synergy opportunities. They should find areas where combining two businesses can save money or boost revenue, and then follow a clear plan to make it happen. At the same time, they need to follow privacy and data laws closely. Here’s how to do it right.

Involve synergy tracking KPIs during deal modeling

Synergies must be measurable from the outset to avoid post-deal value erosion. Clear KPIs hold teams accountable and track progress.

| Synergy Type | Example KPIs |

|---|---|

| Cost Synergies | Headcount reduction %, SG&A savings, procurement cost reductions |

| Revenue Synergies | Cross-sell revenue growth, customer retention rates, market share increase |

| Operational Synergies | Production efficiency gains, IT integration savings, R&D cycle time improvement |

| Financial Synergies | Debt cost reduction, tax savings, working capital optimization |

Use VDRs to maintain synergy-related work streams

Use virtual data rooms to keep all synergy-related information in one place. This includes things like costs, customer info, and IT details. VDRs also let deal teams and integration managers work together easily and in real time.

Here’s how to use VDRs at different stages:

- Before the deal, store your synergy plans, research, and comparison data.

- During integration, track progress, risks, and compliance papers.

- After the merger, save proof of synergies for reviews and audits.

Ensure data security and compliance under Canadian privacy laws (PIPEDA)

PIPEDA (Personal Information Protection and Electronic Documents Act) governs how private data is handled in M&A. Synergy analysis often involves sensitive employee, customer, and financial data. Here is a simple compliance checklist:

- Anonymize data. Remove personally identifiable information (PII) where possible.

- Set access controls. Restrict VDR permissions to authorized users only.

- Conduct audit trails. Log all document access for regulatory compliance.

- Ensure secure Disposal. Purge unnecessary data post-integration per PIPEDA guidelines.

Case study: How VDR use improved synergy capture in a Canadian M&A deal

One mid-sized Canadian tech firm (AcquirerCo) acquired a competitor (TargetTech) to expand its AI solutions portfolio. While the deal promised $25M in projected synergies, past experiences showed that 60-70% of expected synergies often failed to materialize.

They faced the following challenges:

- Overlapping operations in R&D, sales, and back-office functions required precise tracking.

- Regulatory compliance (PIPEDA) added complexity to data sharing.

- Dispersed teams (Montreal + Vancouver offices) needed real-time collaboration.

To overcome these challenges, the acquirer implemented a virtual data room to manage synergy identification, validation, and execution. Here is how it worked:

Phase 1: Pre-merger preparation & synergy projections

Leadership from both the acquirer and the target company used the VDR to upload:

- Financial statements (cost structures, revenue streams)

- Org charts (duplicate roles flagged for cuts)

- Customer/contract data (cross-selling opportunities)

They stored industry reports in the VDR to validate synergy assumptions, like typical IT integration savings in tech M&A. They defined KPIs and applied VDR AI redaction to anonymize employee data per PIPEDA. They also set granular user permissions so that the finance team could access cost models but not customer PII.

Outcomes:

- Synergy projections were data-driven, not speculative.

- Regulatory risks were mitigated early.

Phase 2: Post-merger synergy tracking & execution

After the deal closed, they continued using the VDR to track their progress. Here are the achieved synergies:

- Cost synergies

- Uploaded real-time headcount reports to track layoffs/retention.

- Shared procurement contracts to consolidate vendors (achieved $4.2M savings Y1).

- Revenue synergies

- Used VDR dashboards to monitor cross-sales pipelines.

- Logged customer feedback to adjust bundling strategies ($7M revenue boost).

- Integration milestones

- IT teams shared system migration timelines in the VDR.

- Legal teams tracked contract reassignments with audit trails, which streamlined a complex process of legal due diligence in Canada.

In the end, the company captured 82% of the synergies they had planned. This is far better than the industry average. They also avoided any privacy violations thanks to the secure setup of the VDR. For them, using a virtual data room turned what could have been a messy, high-risk deal into a smooth and successful integration.

Conclusion

A good synergy planning is what helps M&A deals succeed. Virtual data rooms keep things organized and help teams work together smoothly. They also keep sensitive data secure and ensure companies follow privacy and compliance rules.

But VDRs do more than just store files. They support better teamwork, faster decisions, and smoother integration after the deal. When used well, VDRs help create synergies and turn projected value into real business results. For Canadian companies, using a secure VDR is a smart step toward stronger, more successful mergers.

Frequently asked questions

What is synergy in business?

Synergy is the extra value created when two companies merge. It makes the combined company worth more than the two companies on their own. It comes from cost savings, potential financial benefits, or strategic perks.

What are common synergy pitfalls in M&A?

Many deals overestimate savings or fail due to culture clashes, slow integration, or regulatory blocks.

How do you quantify synergies during due diligence?

Compare past deals (e.g., “banks usually cut 20% costs”), model financials, and audit operations (like overlapping offices). Tools like virtual data rooms help organize this analysis.

Are synergy estimates audited in Canadian deals?

Pre-deal, no, but boards and investors review them. Post-deal, some firms hire auditors to verify savings. Public companies must disclose assumptions under Canadian securities rules. Private equity firms don’t have to disclose them, but they often validate estimates for internal planning and future exits.