Post-merger integration (or PMI) is the final step in M&A, bringing two companies together into a meaningful, working whole.

The post-merger integration process is defined not only by the buying company’s overarching acquisition strategy, but also by the nuts and bolts of each company’s inner workings — anything from logistics and production flows, employees’ compensation packages, company guidelines and decision-making principles.

There is no overstating the importance of this step. Successful post-merger integration means a successful deal, but it’s also in integration that unforeseen challenges and obstacles will finally reveal themselves. In fact, More than three-quarters (78%) of respondents reported that their firms worked on more disputes in 2024 compared to the same period in 2023.

Who is responsible for the post-merger integration process?

PMI is above all else a team effort that involves stakeholders from all levels of the company. That said, there are some key roles in charge of the PMI process, both in macro terms of overall strategy and in micro terms, to deal with the more mundane (but equally vital) aspects of the integration.

The top management

Top management is typically responsible for the overarching vision and strategy of the post-merger integration process, including establishing the desired outcomes in terms of m&a synergies and value creation. These would be the buying company’s CEO, the CFO, and the COO.

Your integration team

For the actual execution of the PMI plan, an integration team is also created. Led by a project manager, the integration team is responsible for executing the PMI plan and ensuring tasks are completed efficiently and on time. The integration team comprises representatives from all the relevant fields of both companies, such as finance, HR, IT, operations, sales, and marketing, who work together to integrate their respective areas and achieve the integration objectives.

A task force

On top of that, a task force is sometimes created to manage the information flow during the PMI process. While its main job is helping smooth out and resolve issues from the management to the labor level, it can also be key in providing information to the new employees and helping integrate the different cultures. Task forces are typically composed of lower-level company members, and do not include the executives.

External consultants

It’s also worth mentioning external players — advisors such as lawyers, accountants, consultants, and investment bankers — that are often involved in the PMI process to help with areas such as legal and regulatory compliance and financial and tax matters, among others.

The following table summarizes the key roles and responsibilities in the PMI process:

| Role | Responsibility |

| Top management | Set vision, strategy, and goals; provide resources and support |

| Integration team | Integrate respective areas; share knowledge and best practices; resolve issues |

| Task force | Manage information flow, help integrate culture differences |

| External advisors | Provide expertise, advice, and support in specific areas |

The post-merger integration process: From start to finish

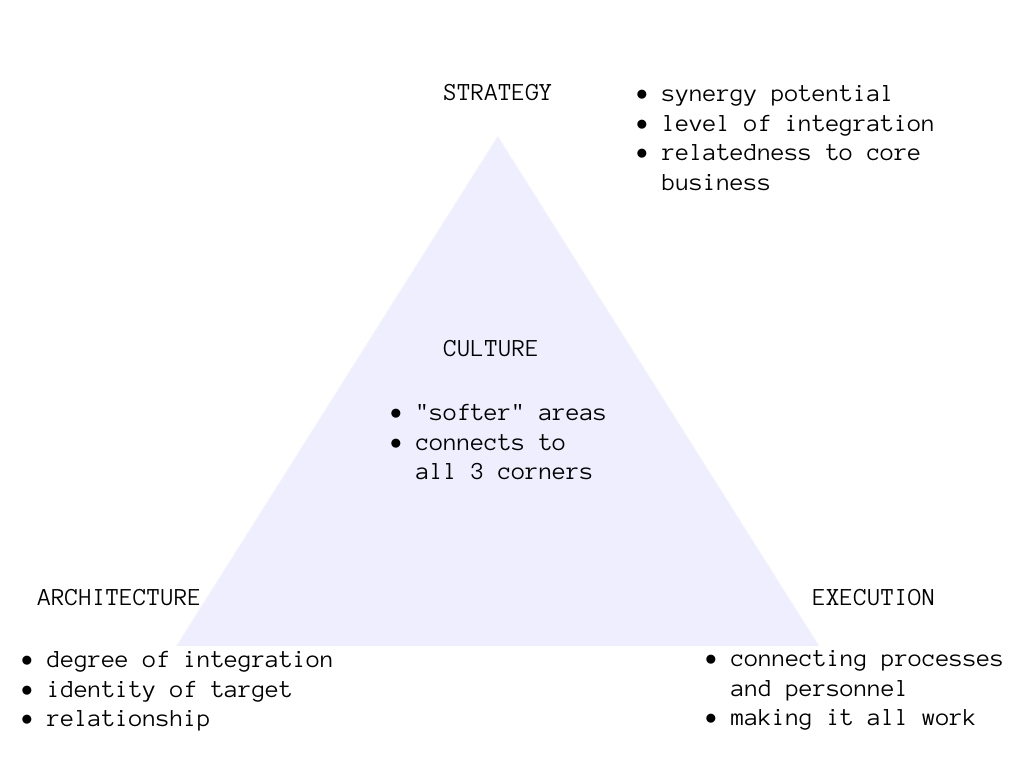

A successful post-merger integration must happen along four dimensions: strategy, architecture, execution, and culture. Let’s take a brief look at what each of these dimensions entail.

Strategy

Strategy includes defining the synergy potential, the desired level of integration, and the target company’s relatedness to the buyer’s core business.

This is where the company’s leadership will be looking at ways to achieve the value creation foreseen in the merger business case, which means attention to strategic objectives, markets, customers, and growth.

Architecture

Your PMI architecture deals with the degree of integration between both companies, the relationship between them, and to what extent the identity of the acquired company is preserved.

The integration management office will be immediately responsible for establishing the overall architecture, which includes formulating the integration roadmap, available resources, and the time frame available for completing the PMI.

Execution

Execution entails the connecting of processes and personnel, making sure both companies can work together as a whole. This means all the “plumbing and wiring” of a company, encompassing everything from merging the IT, legal, tax, and finance integration workstreams, to business and central corporate functions.

The integration team is responsible for the execution, alongside the lead and deputy managers of the different departments.

Culture

Culture encompasses the “softer” — but no less important — areas of post-merger integrations, such as core company values and decision-making principles, and includes issues of communication, change management, training, and feedback across all levels of the workspace.

Many companies will put together an integration task force to facilitate information flows from top to bottom, keeping key stakeholders — including employees and customers — in the loop.

These four dimensions can be represented by a triangle where strategy, architecture, and execution are the corners and culture is the body of the triangle, as it connects to all other aspects.

Key stages of the PMI process

A successful post-merger integration hinges on many different factors, but there are a few essential steps that should constitute the core of any integration process, as follows.

1. Start as soon as possible

The best integration is that which gets started already during the due diligence phase. Proper due diligence staffing (i.e., having the right people head each area of due diligence) is a key step. Begin by defining the main areas for pre-close consideration, including:

- Financial operations

- Management structure

- Legal matters, including material contracts, intellectual property and litigation

- Human Resources (company guidelines, compensation packages, etc.)

- Commercial operations (sales, main clients)

- Logistic flows

- Tax-related ramifications

It’s also in the due diligence phase that you should decide whether or not to hire outside experts to assist and help you navigate the process. Subject matter specialists can be fundamental in high-tech or biotech/life science transactions — there’s no overemphasizing the importance of having senior, more knowledgeable people to help with high-complexity deals.

2. Select the team

Put together a capable post-merger integration team. A successful integration team should be able to handle any hurdles along the way, and should include a mix of hard and soft skills. Good communicators with strong leadership skills, in particular, are a must if you want to prevent slips that lead to losing key employees and valuable clients.

Your integration team should include the integration management office, leadership, and expertise figures from both companies. However, be wary not to staff your team according to a hierarchical line logic. Although an intuitive approach, this risks overwhelming the capabilities of team leaders and department heads, which will be already under significant pressure from the usual responsibilities in their business field added to the demands of the upcoming transition.

Rather, staff your work packages according to relevant expertise, long-term experience with organizational changes, and good soft and team skills.

3. Plan the structure

Plan your integration tasks, activities, and presentations alongside your main business divisions. This allows you to form work streams with their own leadership and management which will effectively act as a sort of “mini pilot projects” for the integration process.

It’s important that each field is staffed by representatives from both companies — the so-called “double boxing”. Roles can be assigned for each section as “Lead Manager” (from the buying company) and “Deputy Manager” (from the acquisition target).

The fields composing your structure will vary according to the size of both companies, among other factors, but can typically include the following sections:

- Project organization: PMI strategy and measures.

- Organization processes/IT: Organization and process structure, shared services, IT integration, etc.

- Production/QM/Service: Product portfolio strategy, production sites and layout, knowledge management, etc.

- Marketing/Sales: Branding, corporate identity, sales strategy, and so on.

- Value chain/Logistics: Value chain management, warehouse management, outsourcing, procurement flows, etc.

- HR/Culture: Cultural integration, staff structure and compensation packages, tasks and responsibilities, job profiles, decision-making principles, etc.

4. Communicate a clear and consistent message

Post-merger integrations are invariably more complex than initially expected. The uncertainty this generates can in turn lead to a significant amount of stress and fear key stakeholders — both within and without the company. The best counter against that is communication — clear, concise, and in just the right amount.

As discussed above, a special task force can help with that. It’s important that all the key management and leadership players be on board with the same message — there’s nothing worse than inconsistent messaging, which creates concerns and can alienate clients and investors, as well as spreading fear inside the company.

5. Establish criteria for completing integration

It’s always easier to define when the merger activity starts than when it ends. But end it must, and for the sake of sparing resources, you should set clear criteria — and at least a tentative time frame — for when a successful integration will be considered complete.

You’ll notice the integration work is nearing completion when the flow of information from employees to the task force begins to wane. Once the integration is deemed complete, your task force should be dissolved so they can focus on their regular roles within the company.

Challenges and best practices of PMI

There are many potential pitfalls in the post-merger integration phase, which often come from the least expected directions. Soft factors such as culture, that are typically neglected, can come back to bite you and cause serious issues in — or even the failure of — your M&A deal.

Let’s take a look at some of the main challenges and corresponding best practices of PMI.

Challenge 1: Culture

As many as 41% of failed M&A deals in 2021 owed their lack of post-merger integration success to a poor cultural understanding and/or lack of trust between buyer and acquired company. This is not only the case in cross-border PMI, but also happens when the extent of the integration is not clearly defined.

Best practices for proper cultural integration

- Make sure both sides have a proper understanding of what will be the dominant culture resulting from the deal. Will the seller’s culture be morphed into that of the buyer? Or will you work to create a hybrid culture with the best of both sides? These questions should be clear to all the key players from early on.

- Define the extent to which cultural integration will actually happen. Cultures can be different, yet highly compatible and even complementary. Successful integration will vary for each case — as an example, different reward cultures can continue to coexist in the merged company; on the other hand, decision-making and prioritization principles are best merged into a coherent plan for everyone.

Challenge 2: Retaining key employees

The PMI process can be incredibly stressful due to uncertainty and higher workloads. According to a 2020 study, 33% of acquired employees leave within the first year of the purchase. The resulting loss of talent can significantly impact the intended value of the acquisition.

Best practices for retaining workforce

- Communicate early and often. Have an HR team ready to address employees’ questions at all times. Act in full transparency at all times.

- Integrate company workers as much as possible through presentations and joint task execution. Where necessary, ensure employees are properly presented to their counterparts in the other company.

Challenge 3: Unrealistic goals

The initial excitement and enthusiasm that drives the merger can be a good thing, energizing the leadership and workers alike. But it often leads to oversized objectives and unrealistic expectations. When these fall short, companies can be left with a disorganized strategy, delayed deadlines, and over expenditure of resources that outweigh the potential gains from the acquisition.

Best practices for setting realistic goals

- Set meaningful systems to define, measure, and adjust your objectives. A fundamental step is articulating a generous, but not over-extended time frame within which clearly defined results must be achieved.

Challenge 4: Retaining your customer base

M&A deals can often result in time and resources being directed away from clients and into the transaction. When this happens over a prolonged period, the impact on customers will lead them to start looking for alternatives elsewhere. Few outcomes can be more disastrous for both buy-side and sell-side.

Best practices for retaining your customers

- Give extra, not less attention to your customers before and during the whole PMI process. Communicate a compelling and consistent message on why the merger is good for them.

- Look for advantages to showcase — things like lower pricing, better service and support, and so on. If yours is a diversification merger that will result in additional product lines and services, make sure to have your cross-selling game ready.

Challenge 5: Matching the integration structure

Be careful not to go overboard with your integration structure. Especially in the case of large corporations acquiring startups or small businesses, it is often overlooked that small organizations follow much more modest standards of internal structuring.

Thus, a large company may assign a 20-strong IT task force only to be then met by a single individual from the startup. This would place an excessive load on the startup side, seriously eroding its ability to proceed with its daily work during the course of the integration — which, in its turn, risks permanently losing company talent or event clients.

Best practices for matching both companies’ structures

As usual, the golden mean in your structure will be achieved through plentiful communication. Look to clearly understand the capabilities of the target company in terms of time and personnel before imposing a rigid PMI structure.

Key takeaways

PMI is the critical final step in any merger or acquisition — it’s what makes or breaks the post-merger integration success of a deal. In fact, as much as 26% of M&A deals in a single year failed due to a simple reason: a faulty strategy. This is why it’s so important to give proper attention to the integration process.

Above all, understand the integration actually begins long before the integration wheels are set in movement. So do your planning, consider the unique details of your deal, and pick the right people for your team, and you’ll be able to move forward with confidence and achieve your merger goals.

FAQs

What factors increase post-merger integration risk?

The main factors include geographical distance, cultural differences, mismatch of power structures, and financial pressures on either or both organizations.

How to reduce post-merger integration risk?

Risk can be reduced by setting up proper risk management procedures early on and making sure risk aspects are a key element in your overall corporate strategy.

What is double boxing in a post-merger integration?

Double boxing refers to the practice of staffing integration workstreams with workers from both buyer and seller companies, which increases communication and ensures a smoother post-merger integration process.

Who is responsible for post-merger integration?

Post-merger integration happens on several levels. The main responsible parties are corporate leadership, including the CEO, CFO, and COO, as well as the post-merger integration management team, and outside consultants or advisors.

What are the main challenges of post-merger integration?

Delineating a proper strategy and matching both companies’ cultures are some of the main challenges.